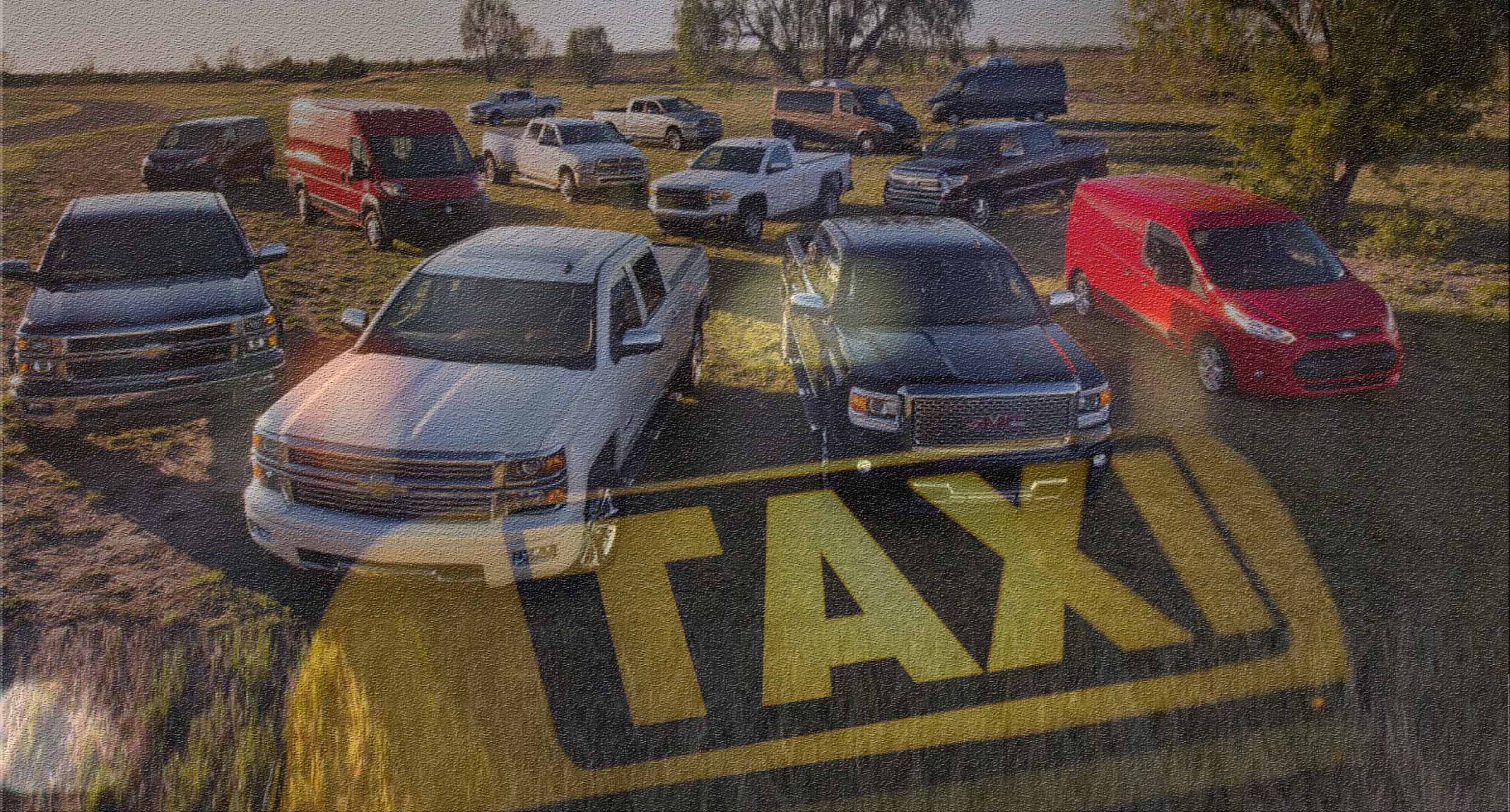

Taxis & Commercial Vehicles

Special tax rates for commercial vehicles. Reduced fees for taxis and trucks with significant savings in import costs.

Carforyou.gr specializes in the import of commercial cars, trucks and taxis. Below we list the customs clearance rates depending on the category of commercial car you are interested in:

Commercial cars

Trucks, except for JEEP type, are subject to a registration fee at the following rates:

| a) Trucks with a gross vehicle weight of over 3.5 tonnes, regardless of cylinder capacity | 5% |

| b) Open trucks with a gross vehicle weight of up to 3.5 tons, regardless of cylinder capacity | 7% |

| c) Closed trucks of gross weight up to 3.5 tons: | |

| Up to 900 cc. | 6% |

| From 901 – 1400 AD | 14% |

| From 1401 – 1800 AD | 18% |

| From 1801 – 2000 onwards | 21% |

| From 2001 onwards | 26% |

d) Truck bases, i.e. chassis, of the previous cases five percent (5%) for case (a) and seven percent (7%) for cases (b) and (c).

e) In the case of closed trucks resulting from the conversion of passenger cars, the fee rates referred to in case (c) of the previous paragraph are tripled and calculated on the taxable value as determined for passenger cars.

f) Open trucks under 3.5 tons that are converted into closed trucks are subject to a registration fee as follows:

| Engine Displacement | P.O. Box (in euros) |

| From 901 to 1,400 cubic centimeters | 733 |

| From 1,401 to 1,800 cubic centimeters | 1.027 |

| From 1,801 to 2,000 cubic centimeters | 1.467 |

| From 2,001 cubic centimeters and up | 2.347 |

g) Open or closed trucks resulting from the conversion of tractors, passenger cars (buses), refrigerated trucks and special-purpose trucks are subject to a registration fee as follows:

| Gross weight | P.O. Box (in euros) |

| From 3.5 to 7.5 tons | 1.000 |

| From 7.5 to 14 tons | 1.800 |

| From 14 tons and above | 2.500 |

When the conversion results in a tipper or tanker vehicle, the above amounts are increased by 500 euros.

Exceptions

Electric trucks are not subject to a registration fee.

2. TAXI

For passenger cars that meet the specifications of EURO 6 or a later directive, regardless of the fuel they use, which are intended to be circulated for public use, 13% of the registration fee for similar, anti-pollution technology passenger cars is paid.

Observation:

Import and classification as a taxon is permitted only for the last 5 years.

The import of used E.D.X (taxi) is permitted: a) Gasoline cc 1550 and above b) DIESELcc1450 and above

c) hybrid & LPG engines cc1200 and above.

They are charged a classification fee equal to 13 % of the corresponding E.I.X rates.

Exemption from luxury tax

Passenger cars intended for public use (TAXI) are exempt from the luxury living tax.

Declassification

Public use passenger cars, if they are declassified and put into circulation as private use before five years have passed since their customs clearance, are subject to the payment of the difference between the reduced taxes they paid and those in force at the time of their customs clearance as private use and based on the tax data formed during the same year. After five years have passed since their customs clearance as public use, no difference in fee is due, but an amount equal to the annual circulation taxes in force at the time of their registration as private use is paid.

NEW

– Gasoline and LPG vehicles must have an engine displacement of at least 1,750 cubic centimeters or more, diesel vehicles must have an engine displacement of at least 1,850 cubic centimeters or more and hybrid vehicles must have an engine displacement of 1,200 cubic centimeters or more.”

– Especially for areas with an altitude of 800 meters and above, E.D.H. cars are allowed to be all-terrain vehicles, but in this case they must have an engine displacement of 1,850 cubic centimeters and above.

Public passenger cars with significant reduction in fees

Trucks with scaled rates depending on weight

Independent of cubic capacity

Independent of cubic capacity

Depending on the cubic capacity

Conversion from public to private use

Adaptation from other types of vehicles

Reduced registration fees of up to 87% for taxis compared to private cars

Taxis are exempt from the luxury living tax regardless of value

Faster cost recovery due to professional use

Taxi:

Trucks: